Mosaic Brands voluntary administration marked a significant turning point for the Australian retail landscape. This case study delves into the complex financial circumstances that led to this decision, examining key indicators, debt structures, and the impact of shifting consumer behavior. We will explore the voluntary administration process itself, analyzing the roles of administrators, creditor meetings, and the eventual restructuring strategies employed.

Finally, we will consider the broader implications for the Australian retail sector and draw valuable lessons for future business practices.

The analysis will cover the impact on various stakeholders, including employees, creditors (both secured and unsecured), and shareholders, providing a comprehensive overview of the consequences of this significant event. We will also examine the restructuring options considered, highlighting the chosen strategy and its effectiveness in addressing the company’s financial challenges. By comparing Mosaic Brands’ experience with similar cases, we aim to provide valuable insights and best practices for avoiding similar situations in the future.

Mosaic Brands’ Financial Situation Leading to Voluntary Administration

Mosaic Brands’ entry into voluntary administration was the culmination of several years of financial challenges, reflecting broader trends within the Australian retail landscape. A confluence of factors, including declining sales, significant debt burdens, and evolving consumer preferences, ultimately contributed to the company’s inability to meet its financial obligations. This section details the key financial indicators and events that led to this decision.

Key Financial Indicators Preceding Voluntary Administration

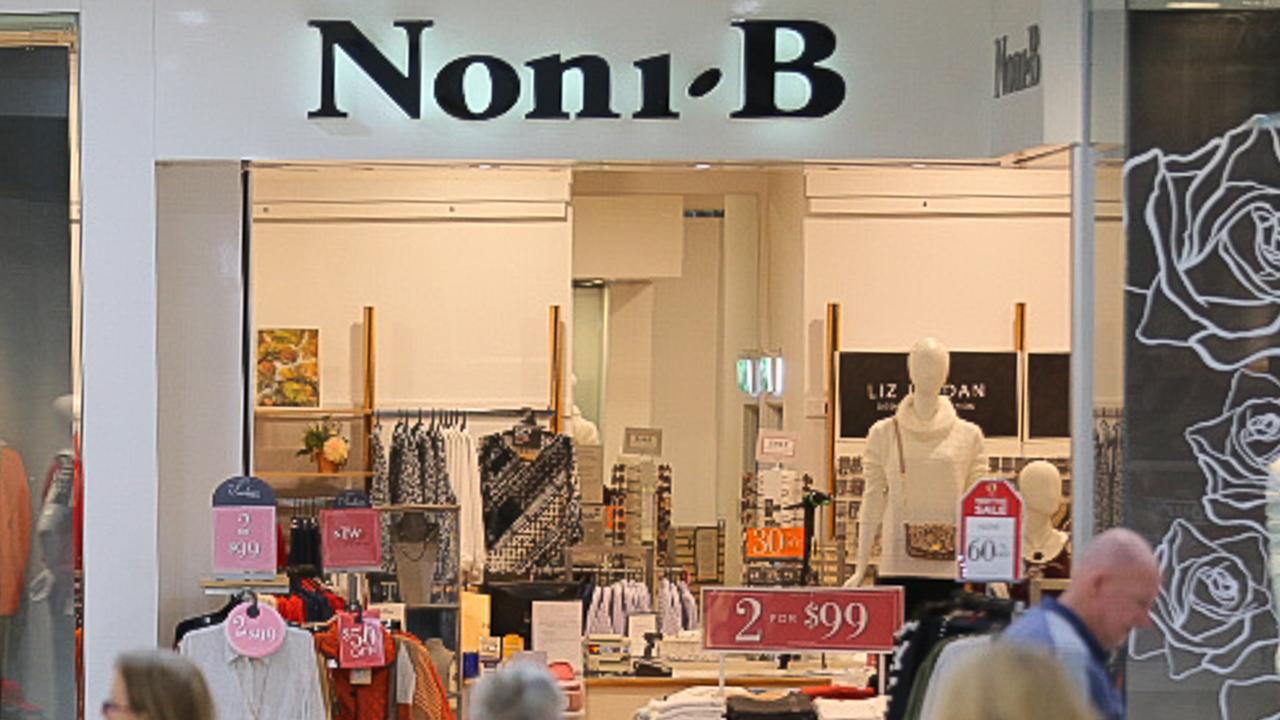

Several key financial indicators pointed towards Mosaic Brands’ deteriorating financial health in the period leading up to its voluntary administration. These included consistently declining revenue, shrinking profit margins, and a rising debt-to-equity ratio. The company struggled to adapt to changing consumer behavior, particularly the shift towards online shopping and the increased popularity of fast fashion brands. This resulted in a significant decrease in foot traffic to its physical stores and a corresponding decline in sales.

Furthermore, increasing operating costs and intense competition within the apparel retail sector further squeezed profitability. These factors, combined with a substantial debt load, ultimately rendered the company unsustainable in its existing form.

Mosaic Brands’ Debt Structure and its Impact

Mosaic Brands carried a substantial debt burden, which significantly exacerbated its financial difficulties. The precise details of the debt structure are complex and would vary depending on the reporting period, but it is known that the company relied heavily on financing to maintain operations and manage inventory. This reliance on debt, combined with declining revenues, resulted in an unsustainable debt-to-equity ratio, making it increasingly difficult for the company to meet its financial obligations.

The high level of debt reduced the company’s financial flexibility, limiting its ability to invest in necessary upgrades, marketing initiatives, or expansion strategies. This constrained its capacity to respond effectively to changing market conditions and ultimately contributed to its financial distress. The weight of this debt played a crucial role in the decision to enter voluntary administration.

Declining Retail Sales and Changing Consumer Behavior

The decline in retail sales was a major factor contributing to Mosaic Brands’ financial woes. The Australian retail sector experienced significant challenges during this period, marked by a slowdown in consumer spending and a shift in shopping habits. The rise of online retailers and the growing popularity of fast fashion offered consumers more choices and competitive pricing, putting pressure on traditional brick-and-mortar stores like those operated by Mosaic Brands.

The company struggled to adapt to this changing landscape, failing to effectively compete with online rivals or capture the attention of younger, digitally savvy consumers. This resulted in a sustained decline in sales, further compounding the company’s financial difficulties.

Timeline of Significant Financial Events

While precise dates require reference to official company filings, a general timeline of significant financial events leading to voluntary administration would include a period of consistently declining profitability, increased debt accumulation, attempts at restructuring and cost-cutting measures (potentially including store closures), and ultimately, the decision to enter voluntary administration as the situation became untenable. This timeline would highlight a gradual deterioration in the company’s financial position, rather than a sudden crisis.

Each stage would reflect the cumulative impact of declining sales, increasing debt, and the company’s inability to implement successful turnaround strategies.

The Voluntary Administration Process for Mosaic Brands

Mosaic Brands’ entry into voluntary administration followed a prescribed legal process designed to provide a pathway for the company to restructure its debts and potentially avoid liquidation. This process involved several key stages, each with specific timelines and responsibilities.The appointment of administrators marked the commencement of the voluntary administration process. Administrators are independent professionals, typically insolvency practitioners, appointed by the company’s directors to manage the company’s affairs and investigate the possibility of a company restructure.

Appointment of Administrators and Their Responsibilities

The directors of Mosaic Brands appointed administrators from a reputable insolvency firm. These administrators assumed control of the company’s operations and assets. Their primary responsibilities included assessing the company’s financial position, investigating the causes of its financial distress, and exploring options for rescuing the business, such as restructuring debts, selling assets, or seeking a buyer for the entire company.

They also had a duty to act in the best interests of the company’s creditors as a whole. This involved a thorough examination of Mosaic Brands’ financial records, contracts, and operational aspects. They were tasked with preparing a report outlining their findings and recommendations for creditors.

The recent news regarding Mosaic Brands’ voluntary administration has understandably raised concerns among stakeholders. For a broader perspective on such significant business events, consider exploring global economic trends, perhaps starting with a visit to Halo dunia! to gain some context. Understanding the wider economic picture can help us better analyze the implications of Mosaic Brands’ current situation and potential future outcomes.

The Creditors’ Meeting and Voting on Proposals

Following their investigation, the administrators convened a meeting of Mosaic Brands’ creditors. This meeting allowed creditors (those owed money by the company, such as suppliers, banks, and other lenders) to receive a report from the administrators on the company’s financial situation and the options available. Creditors then voted on a proposal put forward by the administrators. This proposal might have involved restructuring the company’s debts, selling off assets, or a combination of both.

The administrators’ report provided detailed information on the financial implications of each option, allowing creditors to make informed decisions. A successful proposal requires a majority vote from creditors.

Flowchart Illustrating the Stages of Voluntary Administration

The following describes a flowchart illustrating the stages. Imagine a flowchart with boxes connected by arrows.Box 1: Company Directors Initiate Voluntary Administration: This box represents the initial decision by Mosaic Brands’ directors to enter voluntary administration.Arrow 1: Points from Box 1 to Box 2.Box 2: Appointment of Administrators: This box details the selection and appointment of independent administrators by the directors.Arrow 2: Points from Box 2 to Box 3.Box 3: Administrators’ Investigation and Report: This box describes the administrators’ thorough investigation of Mosaic Brands’ financial situation and the preparation of a comprehensive report.Arrow 3: Points from Box 3 to Box 4.Box 4: Creditors’ Meeting: This box illustrates the meeting where creditors review the administrators’ report and vote on proposed solutions.Arrow 4: Points from Box 4 to Box 5 (Yes) and Box 6 (No).Box 5: Successful Proposal (Restructuring or Sale): This box represents the outcome where creditors approve a proposal leading to restructuring or a sale of the company or its assets.Arrow 5: Points from Box 5 to Box 7.Box 6: Unsuccessful Proposal (Liquidation): This box shows the outcome where the proposal fails to secure sufficient creditor votes, leading to liquidation.Arrow 6: Points from Box 6 to Box 7.Box 7: Conclusion of Voluntary Administration: This box represents the final stage, whether the process resulted in a successful restructuring or liquidation.The flowchart visually represents the sequential steps of the voluntary administration process, highlighting the crucial role of the administrators and the creditors’ decision-making power.

The outcome hinges on the viability of the business and the creditors’ acceptance of the proposed solutions.

Impact on Stakeholders of Mosaic Brands Voluntary Administration

Mosaic Brands’ voluntary administration significantly impacted various stakeholder groups, each facing unique challenges and potential consequences. Understanding these impacts is crucial for assessing the overall effects of the administration and the potential outcomes for the company and its associated parties. The following sections detail the consequences for each key stakeholder group.

Consequences for Employees

The voluntary administration of Mosaic Brands resulted in job losses across its various retail brands. Employees faced uncertainty regarding their employment status, potential redundancy payments, and the search for new employment opportunities. The level of impact varied depending on factors such as individual employment contracts, length of service, and the specific brand within the Mosaic portfolio. Many employees experienced financial hardship due to immediate job loss and the time required to find new employment.

Consequences for Creditors

Creditors, those to whom Mosaic Brands owed money, faced varying levels of impact depending on their status as secured or unsecured creditors. Secured creditors, those holding collateral against the debt (such as a mortgage on property), generally have a higher priority in the repayment process during administration. Unsecured creditors, those with no collateral, face a higher risk of not receiving full repayment of their debts.

This could include suppliers, banks providing unsecured loans, and even landlords. The potential for partial or complete loss of their investment was a significant concern for unsecured creditors.

Consequences for Shareholders, Mosaic brands voluntary administration

Shareholders, the owners of Mosaic Brands, experienced a significant decline in the value of their investment. The share price typically falls drastically during voluntary administration, potentially leading to complete loss of their investment if the company is liquidated. The likelihood of receiving any return on their investment during the administration process is generally low, depending on the outcome of the administration and the assets available for distribution.

Consequences for Customers

Customers of Mosaic Brands faced disruption to their shopping experience, with potential store closures, changes in product availability, and uncertainty regarding returns and warranties. While not directly involved in the financial aspects of the administration, the disruption caused inconvenience and potentially affected their access to preferred brands and products.

Comparative Impact on Creditors

| Creditor Type | Potential Consequences | Priority in Repayment | Example |

|---|---|---|---|

| Secured Creditors | Potential for full or partial repayment depending on the value of the collateral. | High | A bank holding a mortgage on a company-owned building. |

| Unsecured Creditors | Potential for partial repayment or complete loss of debt. | Low | Suppliers of goods or services. |

The Mosaic Brands voluntary administration serves as a compelling case study illustrating the challenges faced by retailers in a dynamic market. Understanding the financial factors leading to the administration, the complexities of the restructuring process, and the long-term implications for the Australian retail sector offers valuable lessons for businesses and stakeholders alike. By analyzing the key financial indicators, stakeholder impacts, and restructuring strategies, we can gain a clearer understanding of the intricacies of business insolvency and the importance of proactive financial management in navigating economic uncertainties.

The insights gleaned from this case provide a valuable framework for mitigating risks and ensuring long-term sustainability within the retail industry.

FAQ Explained

What were the immediate consequences of Mosaic Brands entering voluntary administration for its employees?

Immediate consequences for employees often included uncertainty regarding job security, potential redundancies, and delays in receiving wages or entitlements. The administrators worked to manage these impacts but job losses were unfortunately likely.

What are the potential long-term effects on the Australian retail sector as a whole?

The case could lead to increased scrutiny of retail business models, emphasizing the need for sustainable practices and adaptability to changing consumer trends. It might also influence future government policies related to retail support and insolvency procedures.

Could Mosaic Brands have avoided voluntary administration? If so, how?

Potentially, through earlier and more aggressive cost-cutting measures, a more agile response to changing consumer preferences, and proactive financial management, including securing additional funding or exploring alternative business strategies. Early identification of financial distress is crucial.